Accrual Automation

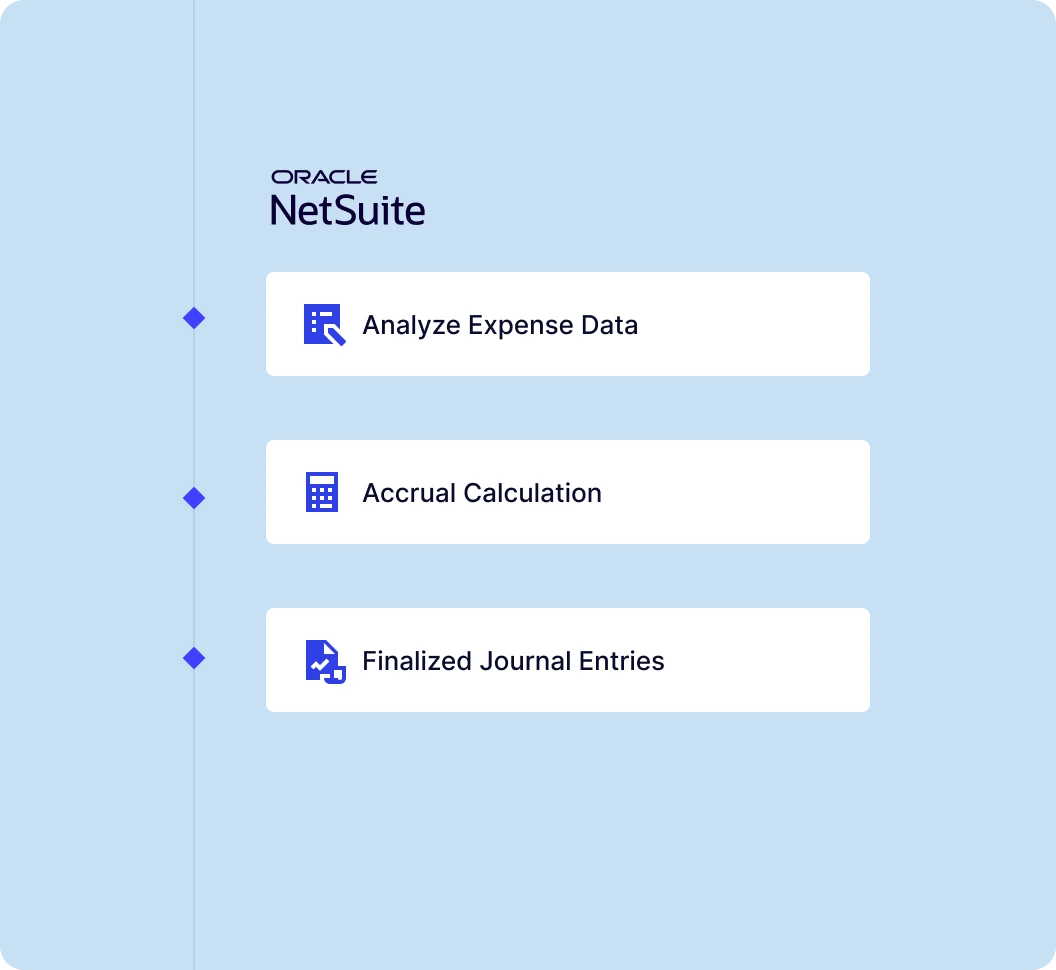

Accelerate financial close with Accrual Automation built for NetSuite

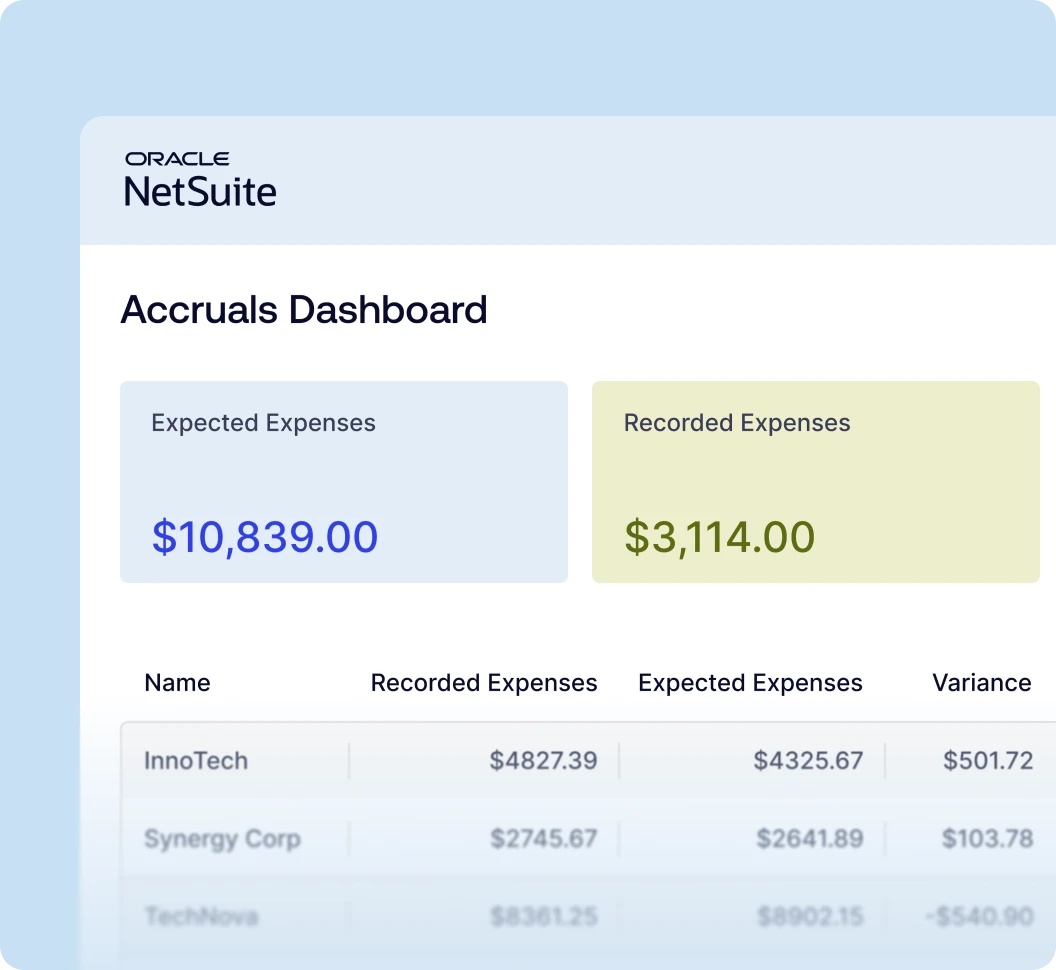

Accelerate month-end close with intelligent expense accrual estimates that boost productivity, improve accuracy, and provide real-time financial visibility. Charted Accrual Automation leverages intelligent spend analysis and seamless approval workflows—fully embedded in NetSuite—to transform your most time-consuming close processes.

Why Charted?

Why finance teams choose Charted Accrual Automation

Charted Accrual Automation features

Transform your AP workflow with Accrual Automation for NetSuite

Comprehensive accrual

scenario management

Handles all common accrual scenarios: regular recurring expenses using historical patterns, contract-based accruals leveraging PO details, and pending approval transactions—ensuring complete financial visibility across your entire AP workflow.

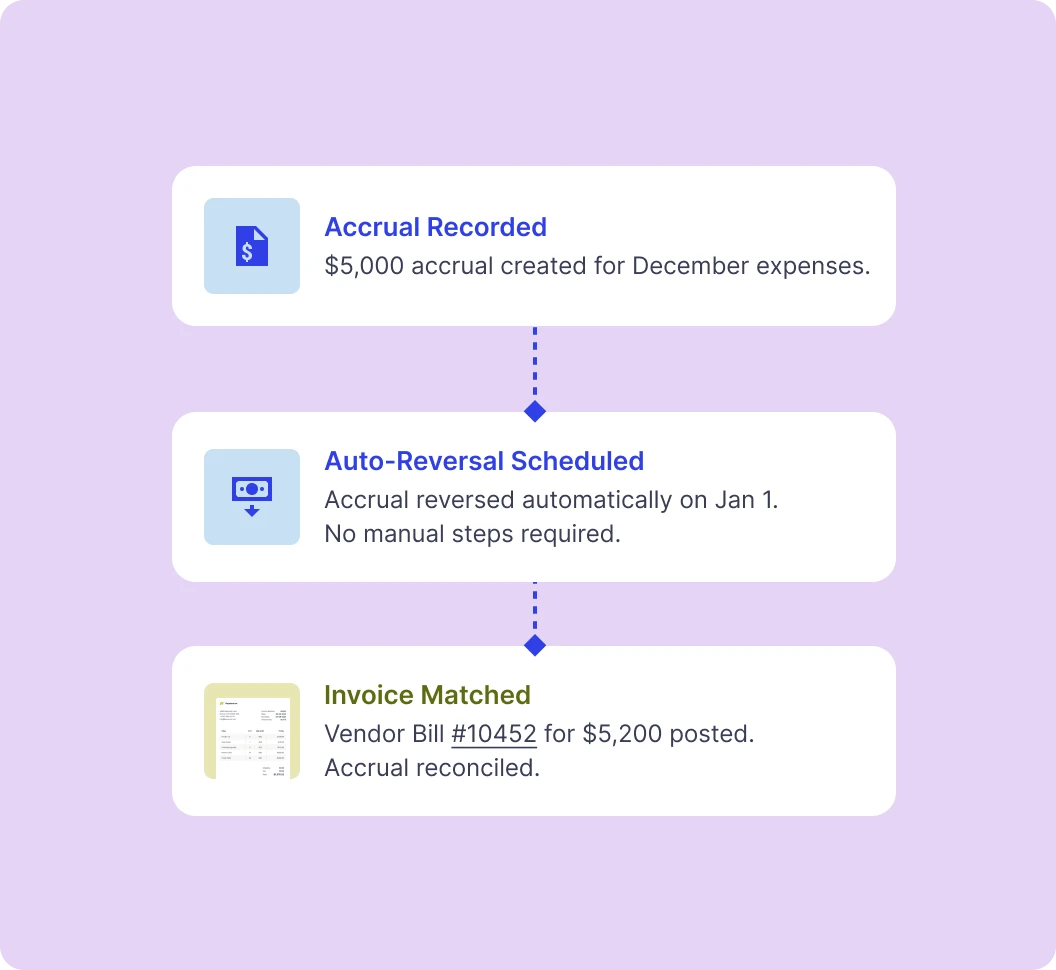

Automated reversal &

reconciliation

Automatically reverses accrual entries when actual invoices are processed to prevent double-counting, eliminating manual reconciliation work while maintaining accurate financial statements and complete audit trails throughout the process.

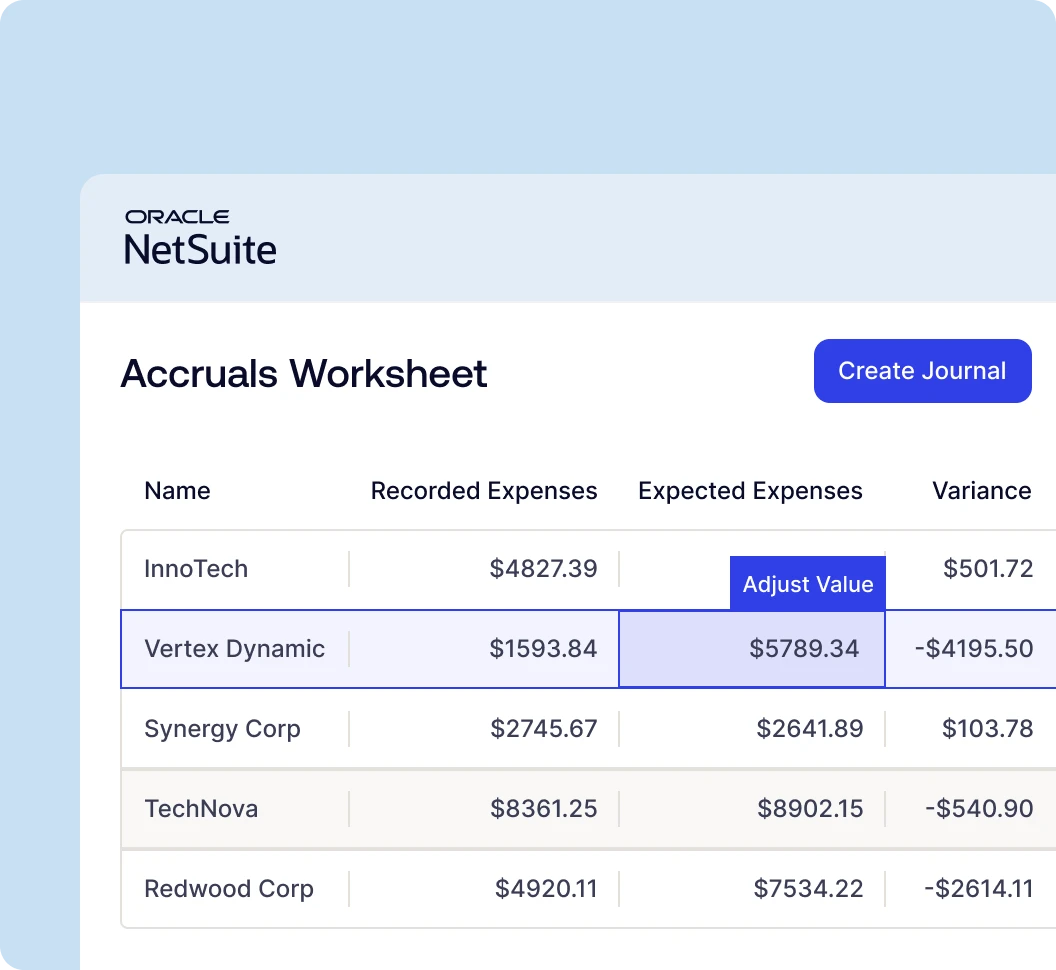

Real-time confirmations & adjustments

Enables real-time confirmations and adjustments to accrual estimates with dynamic updates based on changing business conditions, giving controllers complete flexibility to refine estimates as new information becomes available.

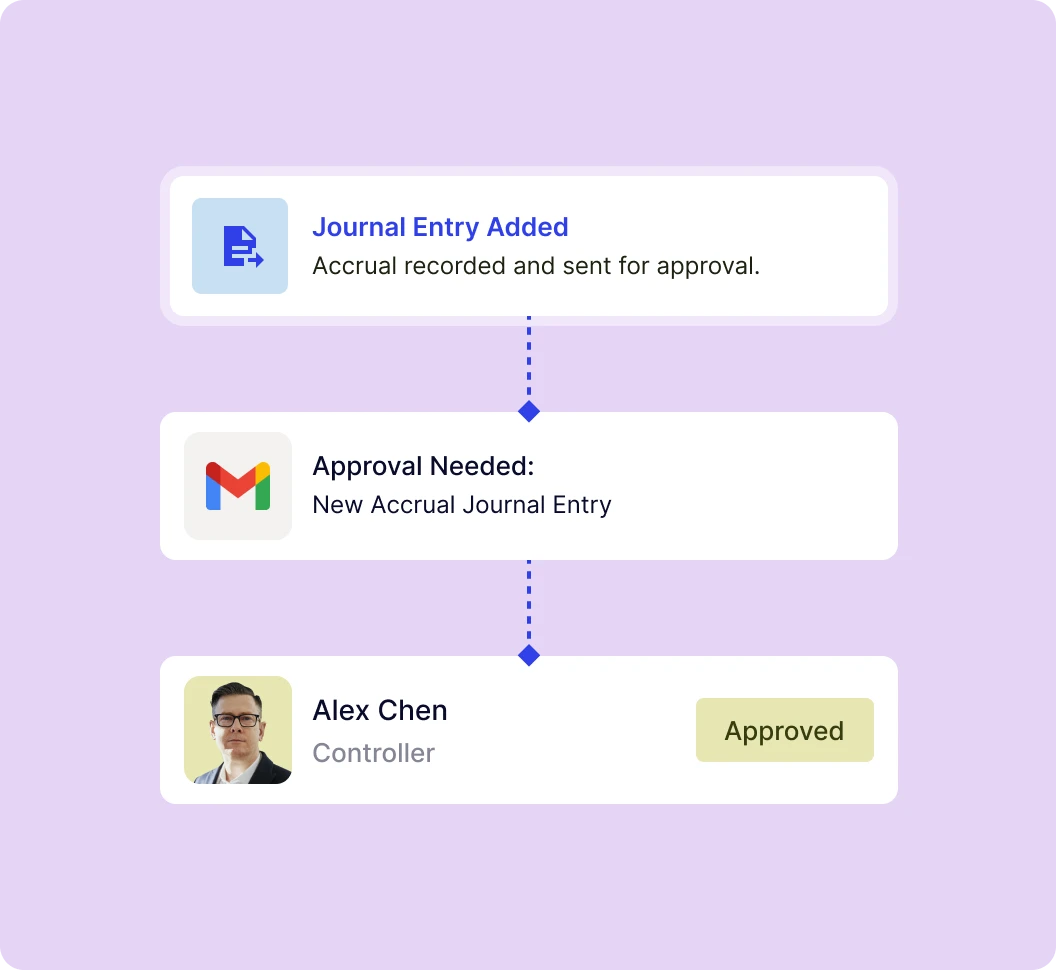

Automated journal creation & routing

Streamlines accrual journal entry creation with one-click generation and automatic routing through your existing approval matrix, allowing approvers to review and approve entries via email without requiring NetSuite licenses while maintaining complete audit trails.

NetSuite-native architecture & compliance

Operating entirely within NetSuite ensures real-time data access, no external systems or API complications, complete GAAP compliance support, and comprehensive audit trails. Leverage your existing NetSuite security and workflow models into data you can trust.

Customer success story

Accrual Automation for NetSuite

Frequently asked questions

Charted is built as a native SuiteApp that analyzes historical vendor patterns, pending transactions, and open purchase orders to automatically generate intelligent accrual estimates directly within your NetSuite environment—no external integrations required.

The system automates three primary accrual scenarios: regular recurring expenses from vendors who bill consistently, contract-based accruals for long-term agreements using PO details, and pending approval transactions that haven’t been recorded yet.

For recurring expenses, the system analyzes the past three months of transaction history to create rolling average estimates. For contract accruals, it uses purchase order information with defined time periods to calculate appropriate amounts based on contract terms.

Yes, the system presents all potential accruals in a consolidated worksheet where you can review, confirm, and make real-time adjustments to estimates before creating journal entries. Accrual Automation gives you complete control over the final amounts

Yes, when actual invoices are processed in NetSuite, the system automatically reverses corresponding accrual entries to prevent double-counting, eliminating manual reconciliation work while maintaining accurate financial statements.

Yes, as a NetSuite-native solution, Charted leverages NetSuite’s built-in multi-currency and multi-entity capabilities, supporting complex organizational structures with multiple subsidiaries, currencies, and accounting periods within a single system.