ACH Payments

End-to-end digital payments without leaving NetSuite

Charted ACH Payments eliminates the fragmented mess that plagues most finance teams when making payments. No switching between banking portals, no vulnerable NACHA files, no separate payment platforms. Intelligent automation works where your data lives, using your existing bank relationships.

By the numbers

ACH Payments transforms AP operations in NetSuite

100%

Payment data stays within NetSuite

60-80%

Reduction in payment processing time

Zero

NACHA files to manage or secure

How it works

Payment automation without the payment headaches

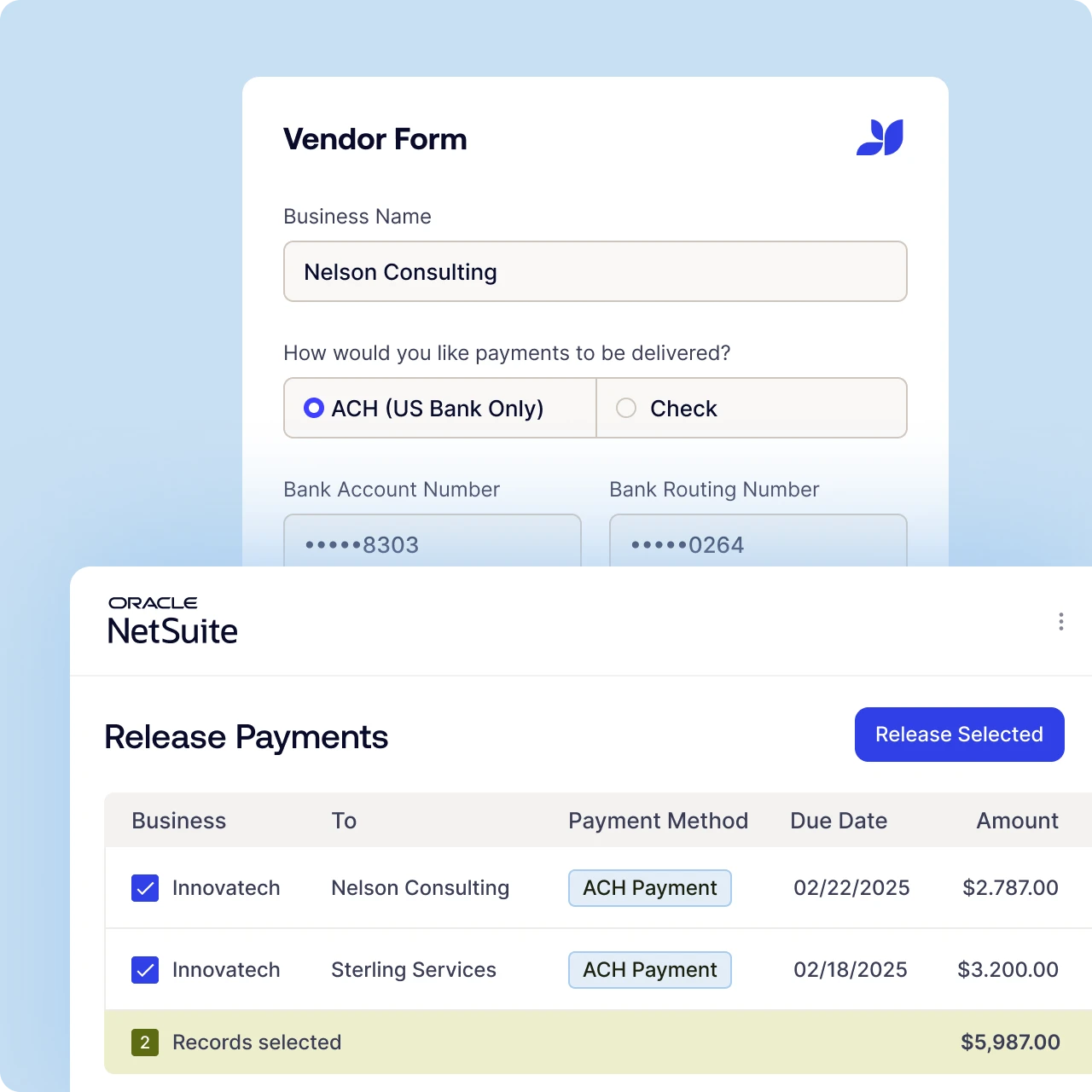

Vendor data collection, done right.

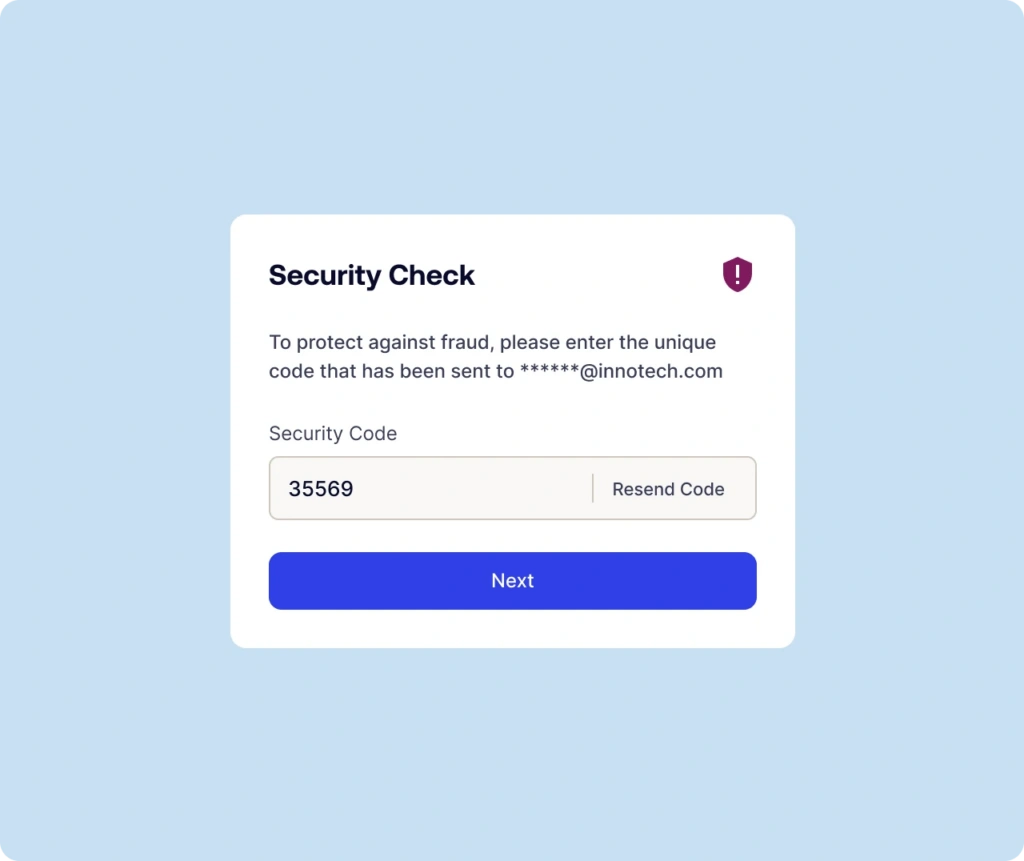

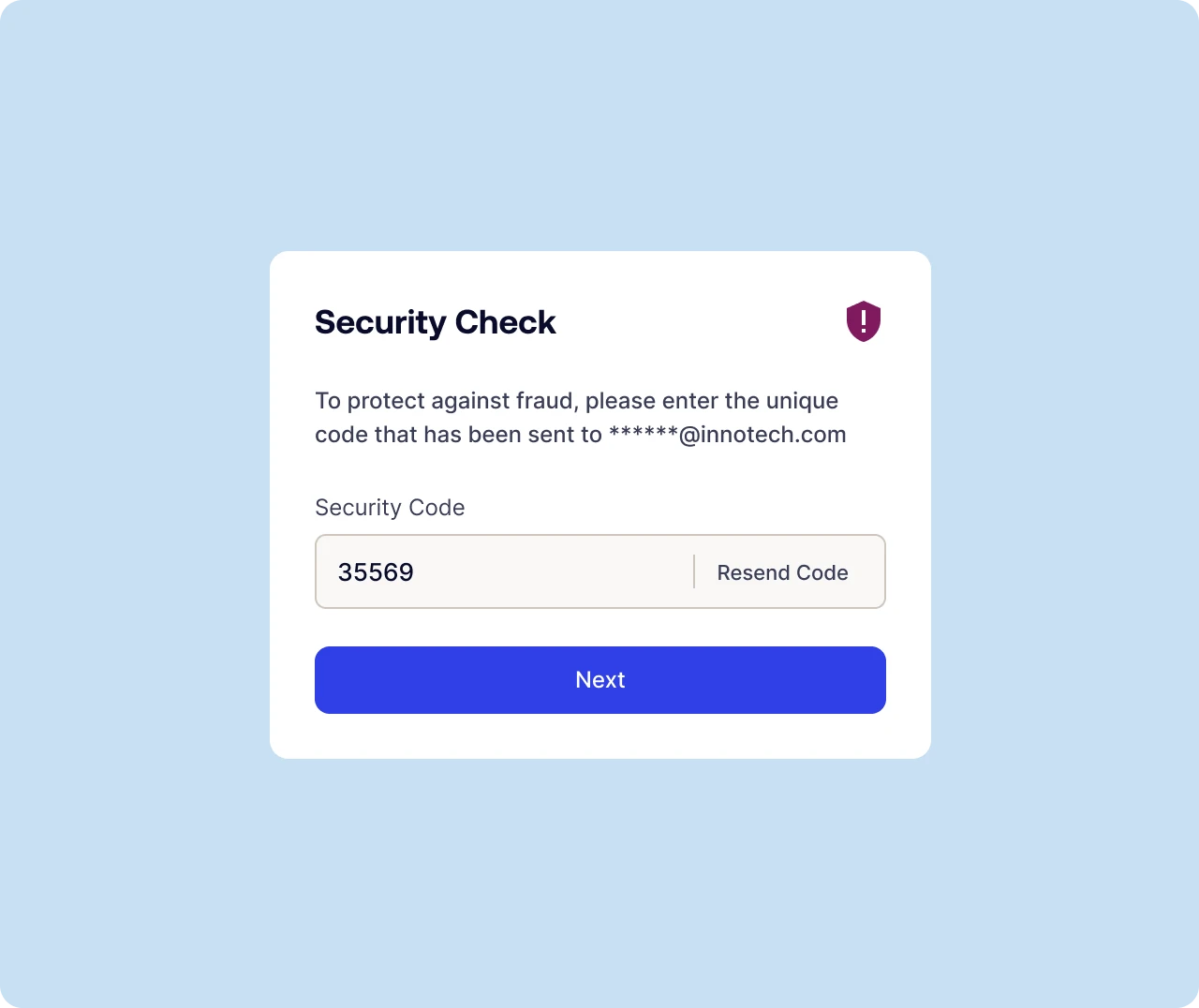

Send vendors secure payment invites with two-factor authentication. No more collecting bank details over email or storing sensitive information in spreadsheets. Vendors choose their payment method while you maintain complete control of the vendor relationship.

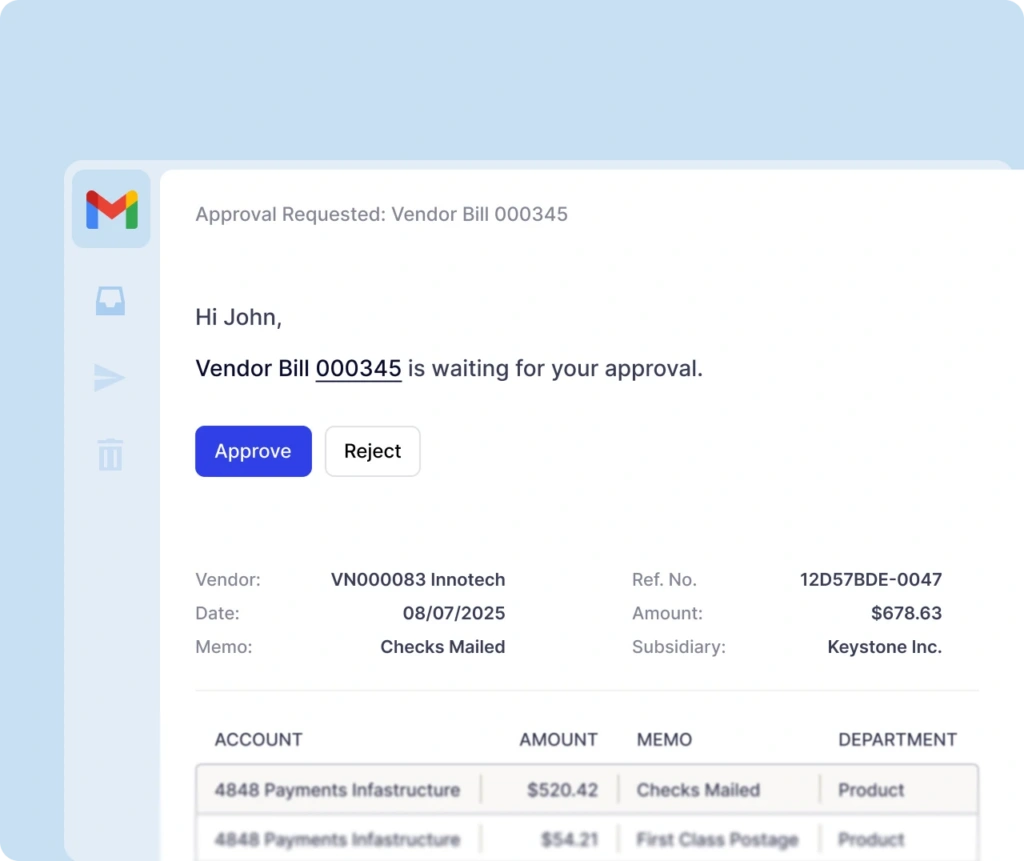

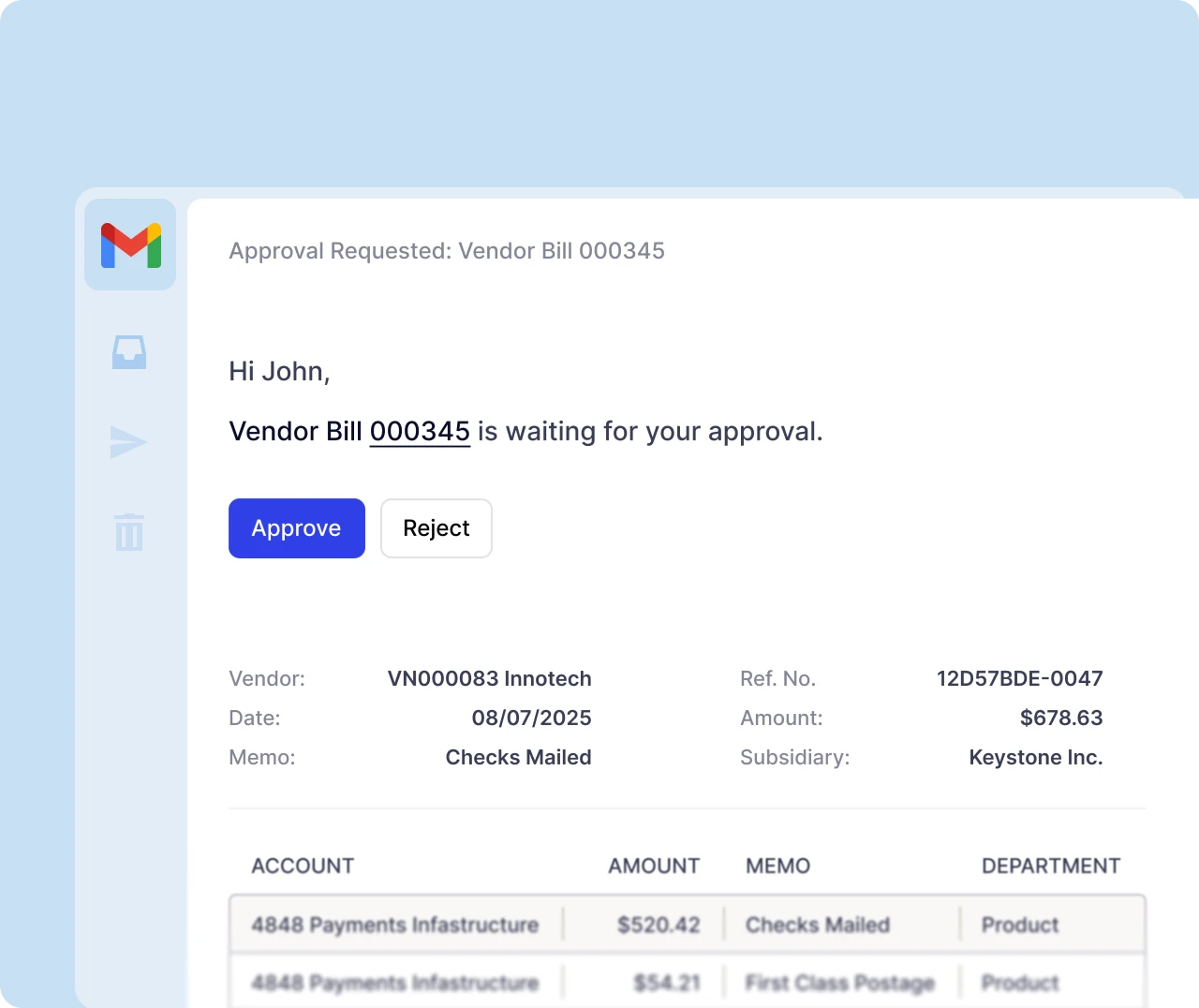

Email approvals that save licenses.

Route payments through sophisticated approval workflows where stakeholders can approve directly from email—no NetSuite license required. Stop forcing approval bottlenecks just to minimize licensing costs.

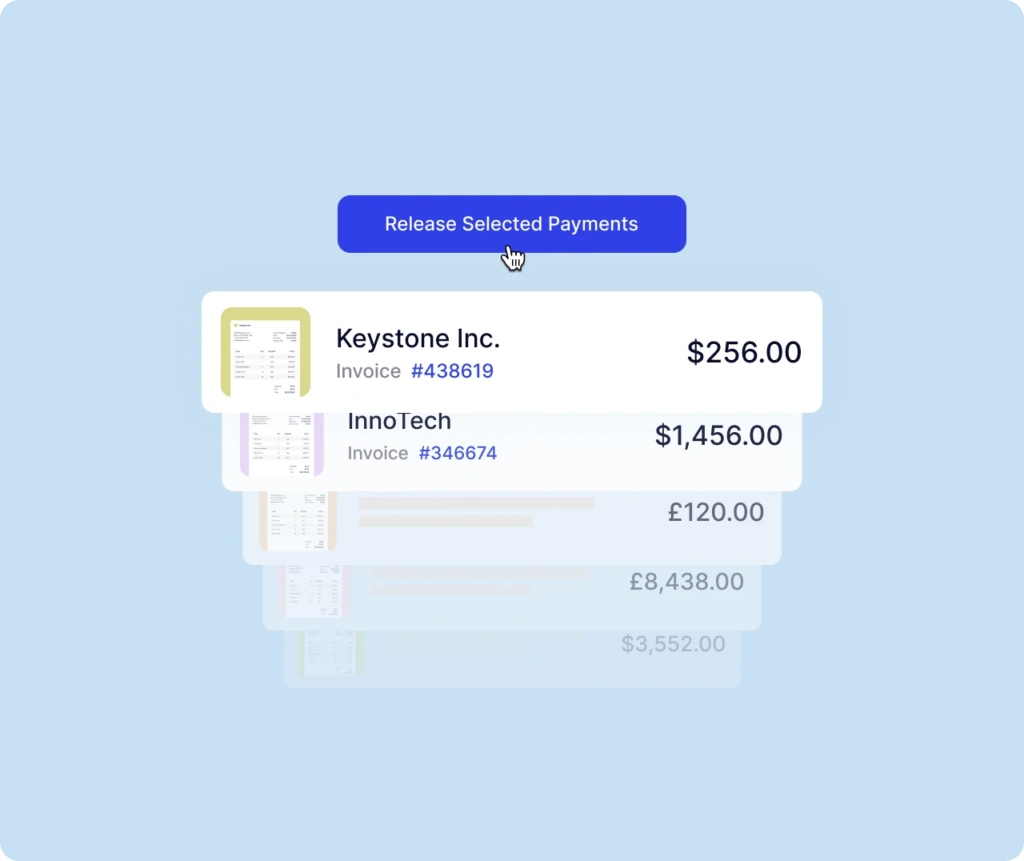

One click. Done.

Release payments directly from NetSuite with zero manual file handling. While other solutions make you download NACHA files and upload them to banking portals, we handle the complexity behind the scenes. Create end-to-end payments, without the back-and-forth.

What’s included

Automation without compromise

Customer success story

For your team

Less admin. More ambition.

Transform manual payment processes into strategic cash flow management across your entire finance organization.

End the NACHA file nightmare and streamline reconciliation with native NetSuite integration. Get complete audit trails without the security risks of manual file handling. Your numbers stay accurate, your auditors stay happy, and you stay sane.

Transform your role from payment processor to strategic partner. Spend less time babysitting banking portals and more time optimizing vendor relationships and cash flow. When payments work seamlessly, you can focus on work that drives the business forward.

Deploy enterprise-grade payment automation without the enterprise headaches. No integrations that break, no external systems to secure, no middleware to maintain. Charted is built directly on NetSuite’s architecture—because your data should have a permanent home.

Implement comprehensive payment automation with zero maintenance burden. Native NetSuite architecture means seamless updates, zero integration issues, and no additional systems for your team to support. Automation that actually reduces your workload.

Frequently asked questions

Yes. Since Charted is NetSuite-native, payments are initiated, approved, and tracked entirely within NetSuite. No external banking portals, no system-switching, no context loss. Just streamlined payments where your data already lives.

Absolutely. With Charted you can select multiple vendor payments and release them as a single batch while maintaining individual tracking and vendor notifications. Implement efficiency without losing control or visibility.

Vendor bank details are kept secure through two-factor authenticated onboarding links with industry-leading encryption. With Charted, there is no external data storage risks, no vulnerable spreadsheets, no email and based bank detail collection.

Yes, with sophisticated approval workflows based on amounts, departments, or custom criteria. Approvers can review and approve directly from email without NetSuite licenses—stop forcing approval bottlenecks to minimize licensing costs.

Payments made with Charted ACH are seamlessly integrated via NetSuite’s Bank Match Data.

Transaction IDs and ACH IDs automatically connect payment batches to bank statements, dramatically reducing manual reconciliation work.

Through multiple security layers including two-factor authentication, encrypted transmission and storage, and elimination of vulnerable NACHA files that can be manipulated. We don’t just add security—we remove security risks that other solutions create.

Yes, Charted is fully compliant through our banking partner relationships. We handle all regulatory requirements behind the scenes so you don’t have to become a NACHA expert to send secure payments.

Complete audit trails are automatically maintained within NetSuite for every payment, approval, and status change. Audit-ready documentation, without the anxiety of scattered records across multiple systems.