International Payments

Pay global vendors without leaving NetSuite

Stop bouncing between systems. Pay global vendors across 160+ countries from a unified NetSuite workflow. Charted Payment Automation consolidates domestic and international payments, automatically routing each through the optimal method while reducing processing costs by up to 60%.

By the numbers

Stop paying the integration tax

$2-$3

IACH fee vs. $25-45 typical bank wire fees

150+

Countries supported without leaving NetSuite

Zero

Additional integrations required

How it works

Payment chaos, solved in four steps

All your payments, finally in one place.

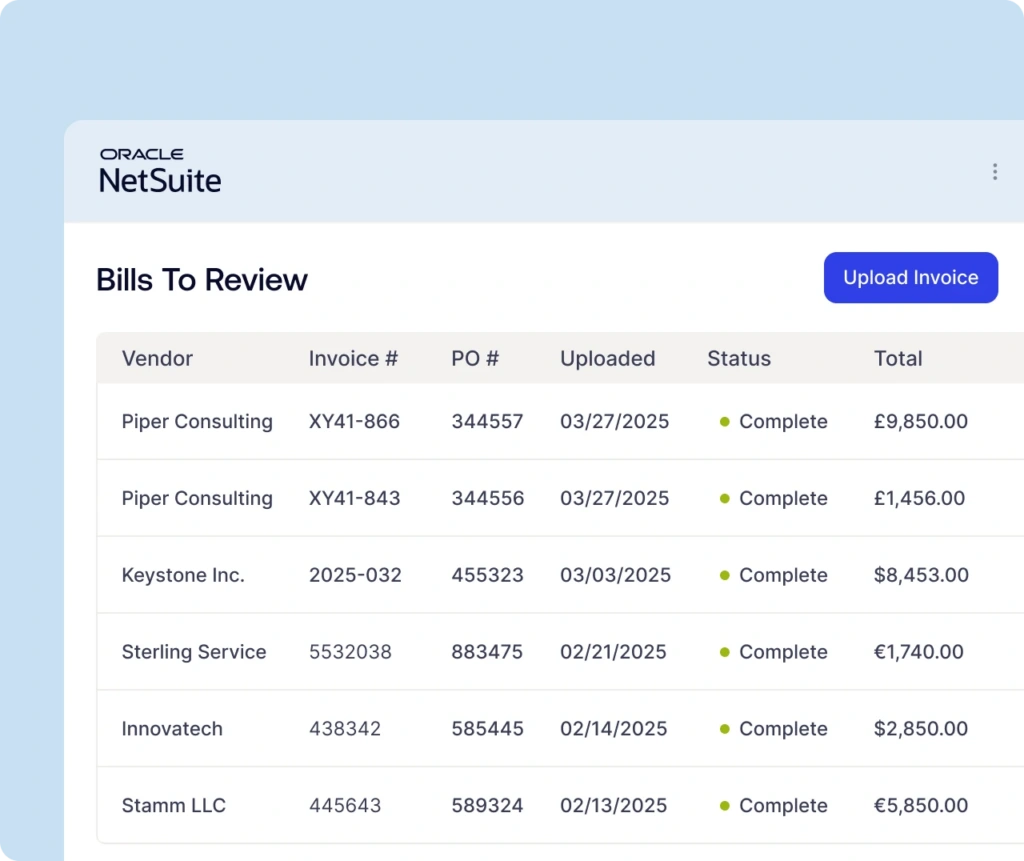

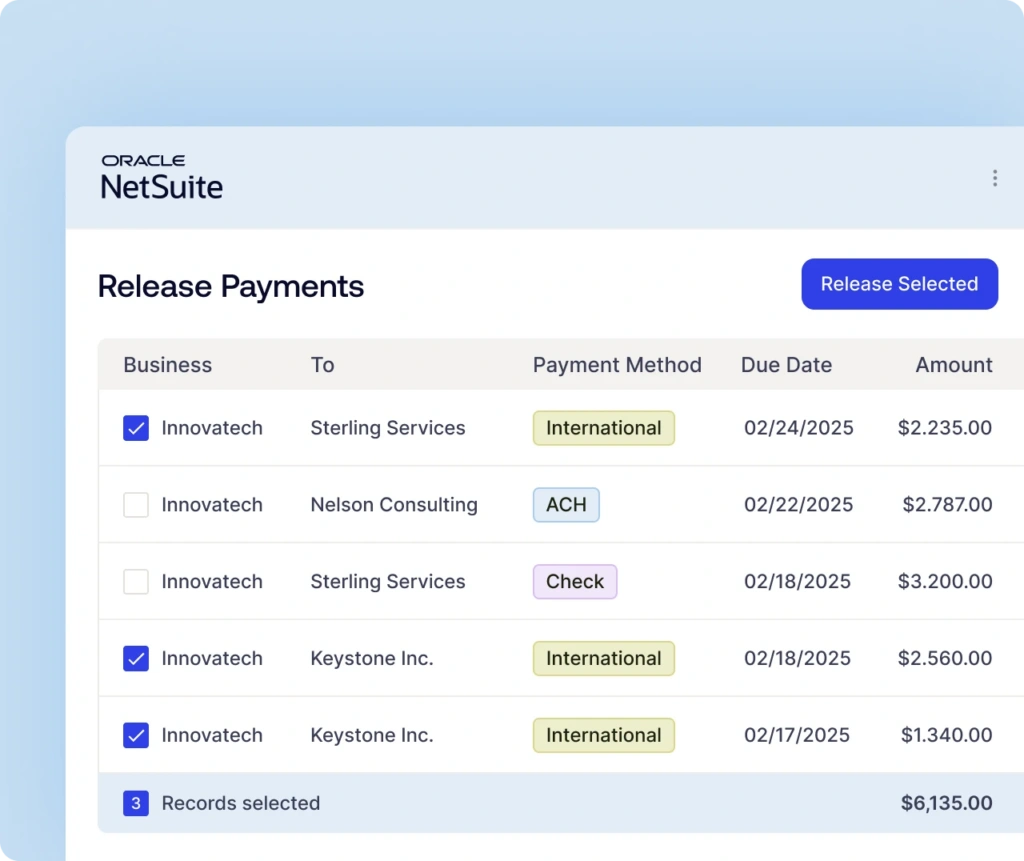

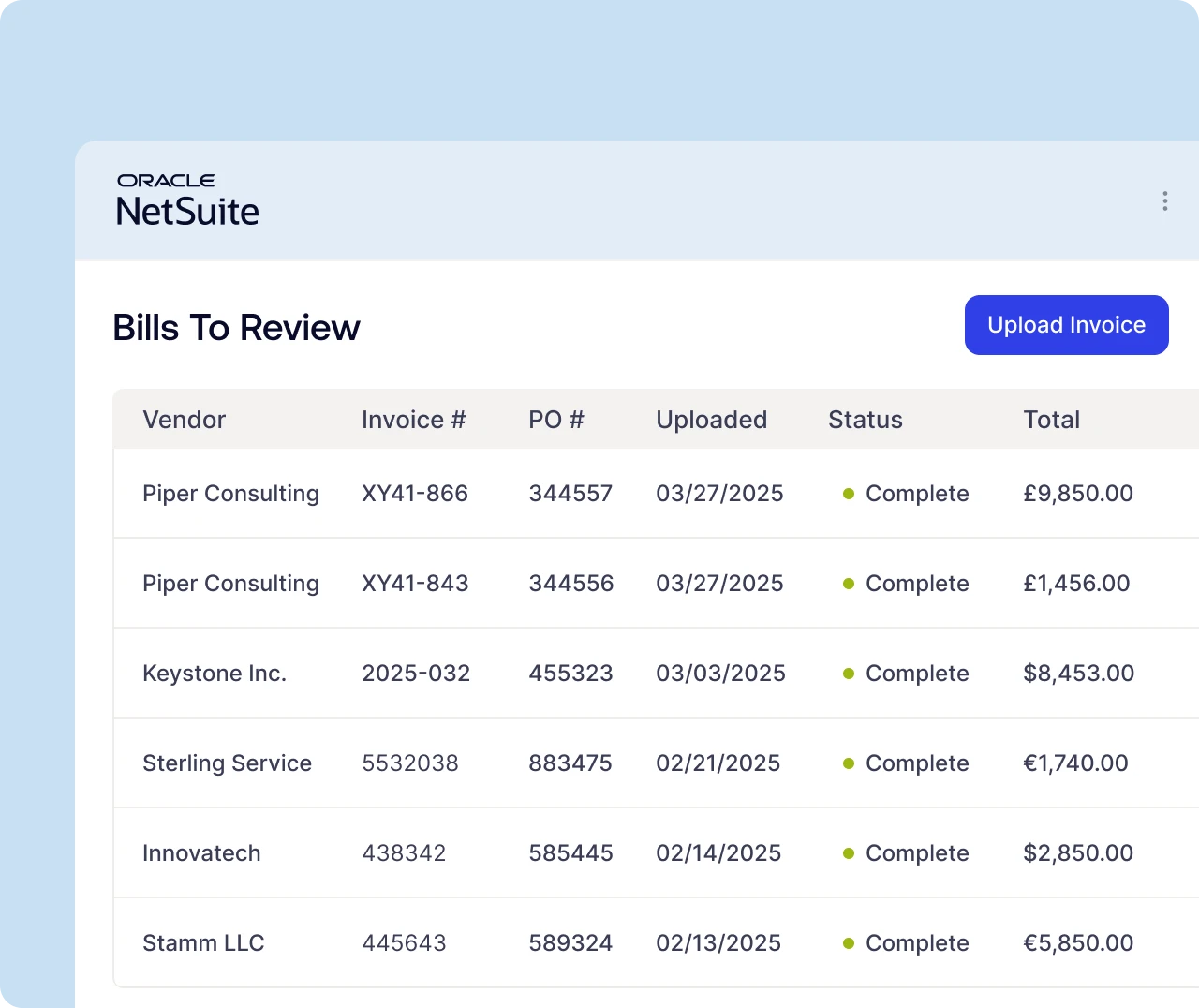

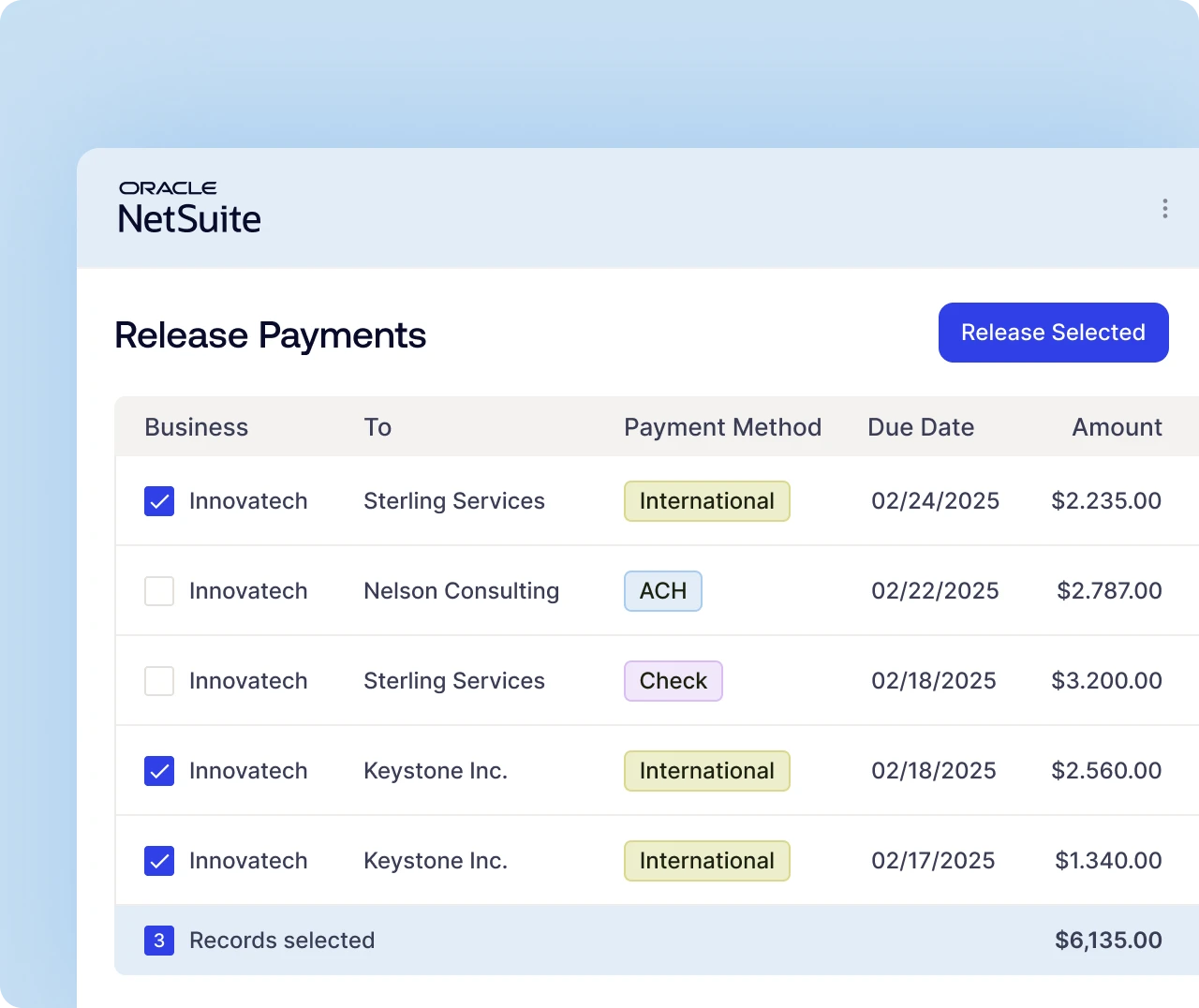

Review domestic and international vendor bills from the same NetSuite interface. No toggling between systems to see what needs paying. The system shows each vendor’s configured payment method and currency automatically—whether it’s US ACH, IACH, international wire, or check payments, they’re all in one unified queue.

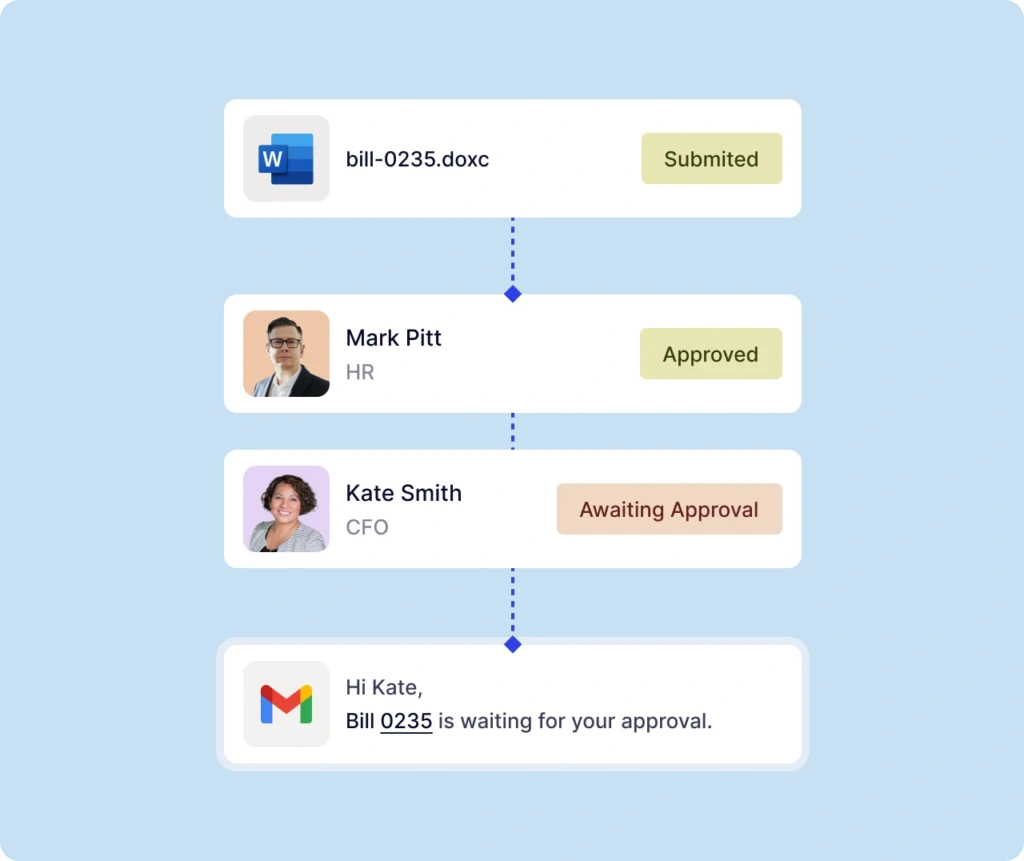

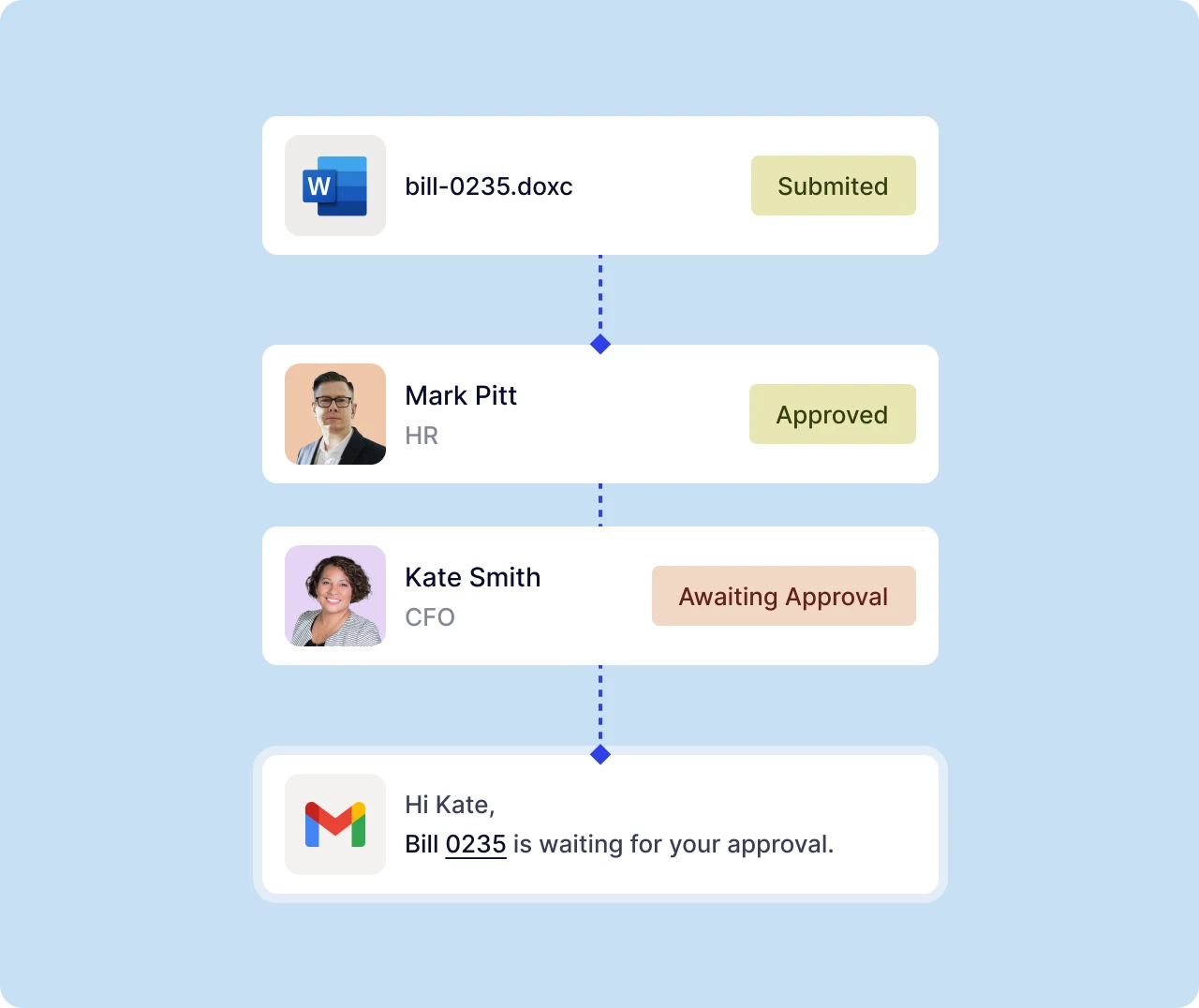

Same approval process, any payment type.

Your approval workflows work the same whether the payment stays domestic or crosses borders. Approvers get detailed email notifications and can approve directly from emails, on any device, without NetSuite licenses.

All vendor payments with one click.

Release your entire payment batch simultaneously. Track everything in real-time within NetSuite, regardless of payment method or destination. Automated remittance notifications keep vendors informed, maintaining professional communication across all payment types, without you lifting a finger.

What’s included

Integration-free global payments, built where finance works

Customer success story

For your team

Turn payment complexity into competitive advantage

Stop letting payment processing overhead drain your team’s strategic focus. International Payments within Charted Payment Automation transforms how finance operates.

Simplify month-end close with all payment types flowing through the same audit-ready processes. No more reconciling across multiple systems—whether it’s domestic ACH, IACH, international wires, or checks, everything tracks in NetSuite. Slash international payment costs by up to 75% without compromising financial controls.

Process all vendor payments from one interface—no more system-switching based on geography. Focus on vendor relationships and payment optimization instead of managing multiple platforms for different payment types.

Deploy global payment capabilities without the integration nightmare. All payment methods operate within NetSuite’s secure environment—no additional systems, no new security considerations, no middleware to maintain.

Enable international payments as a natural extension of your existing automation. No additional integrations, no separate systems—global payments work within the same NetSuite-native architecture you already trust.

Frequently asked questions

Bouncing between payment platforms risks copy and paste errors and creates reconciliation chaos. Charted Payment Automation handles all payment types—domestic and international—within your existing NetSuite workflows, maintaining unified processes and complete audit trails. While other systems stack, we streamline.

It doesn’t need to integrate—it’s built directly inside NetSuite as a native SuiteApp. All payment processing, approval workflows, and tracking happens where your data lives. No connectors, no middleware, no weak integration points, only streamlined payments from start to finish, without ever leaving NetSuite.

We support payments in 150+ global countries and every major currency. Additional currency support is added based on customer needs. International Payments is built for your day-to-day, and your big picture.

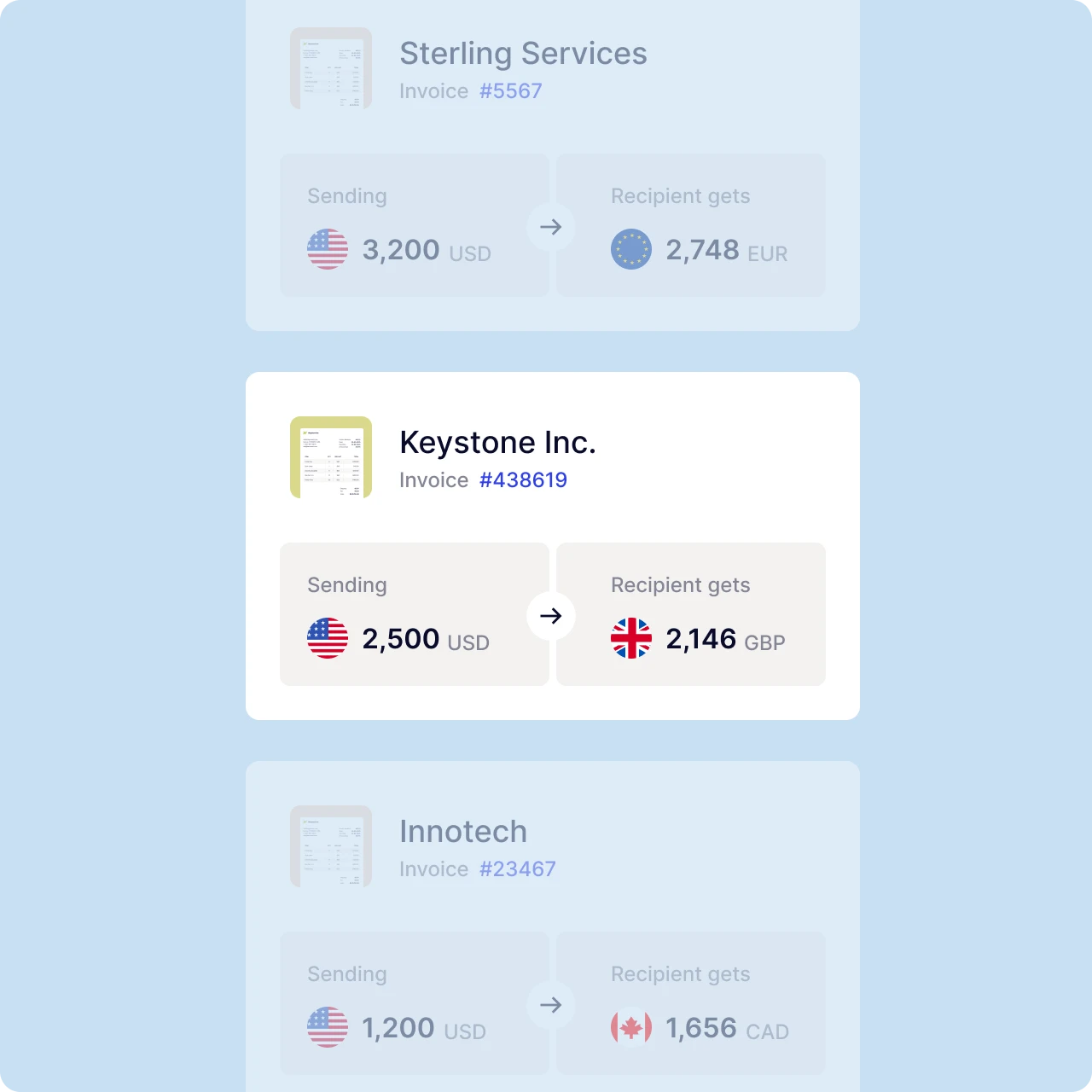

Yes, and it’s automatic. Configure each vendor’s preferred currency and payment method once, then process mixed batches seamlessly. Pay US vendors via ACH, global suppliers in their currency, local contractors by check—all from the same interface.

Charted Payment Automation provides complete payment flexibility: domestic ACH and check payments, plus international wire transfers, and IACH for cross-border payments. Each vendor gets configured with their optimal method for automatic routing—no manual decisions required.

Yes, with competitive rates through our banking partner. Domestic payments process at face-value; international payments handle currency conversion transparently. All FX processing happens securely with real-time calculations captured directly in NetSuite—no manual currency management or separate FX services needed.

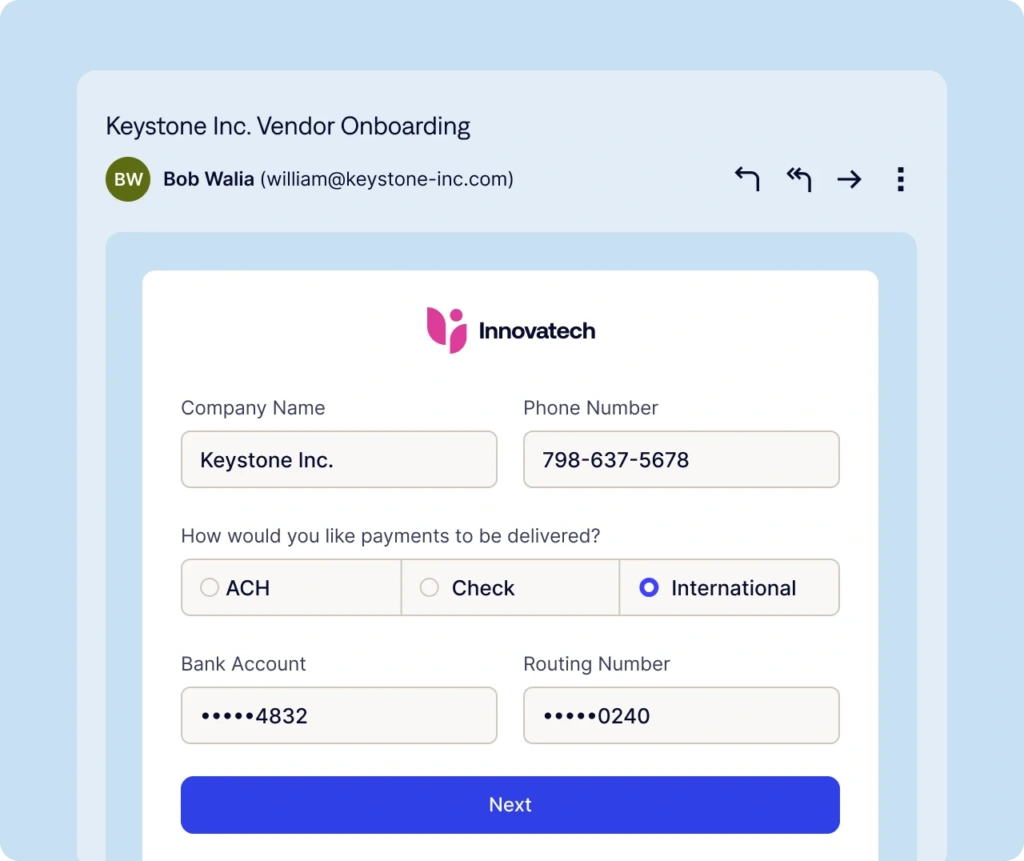

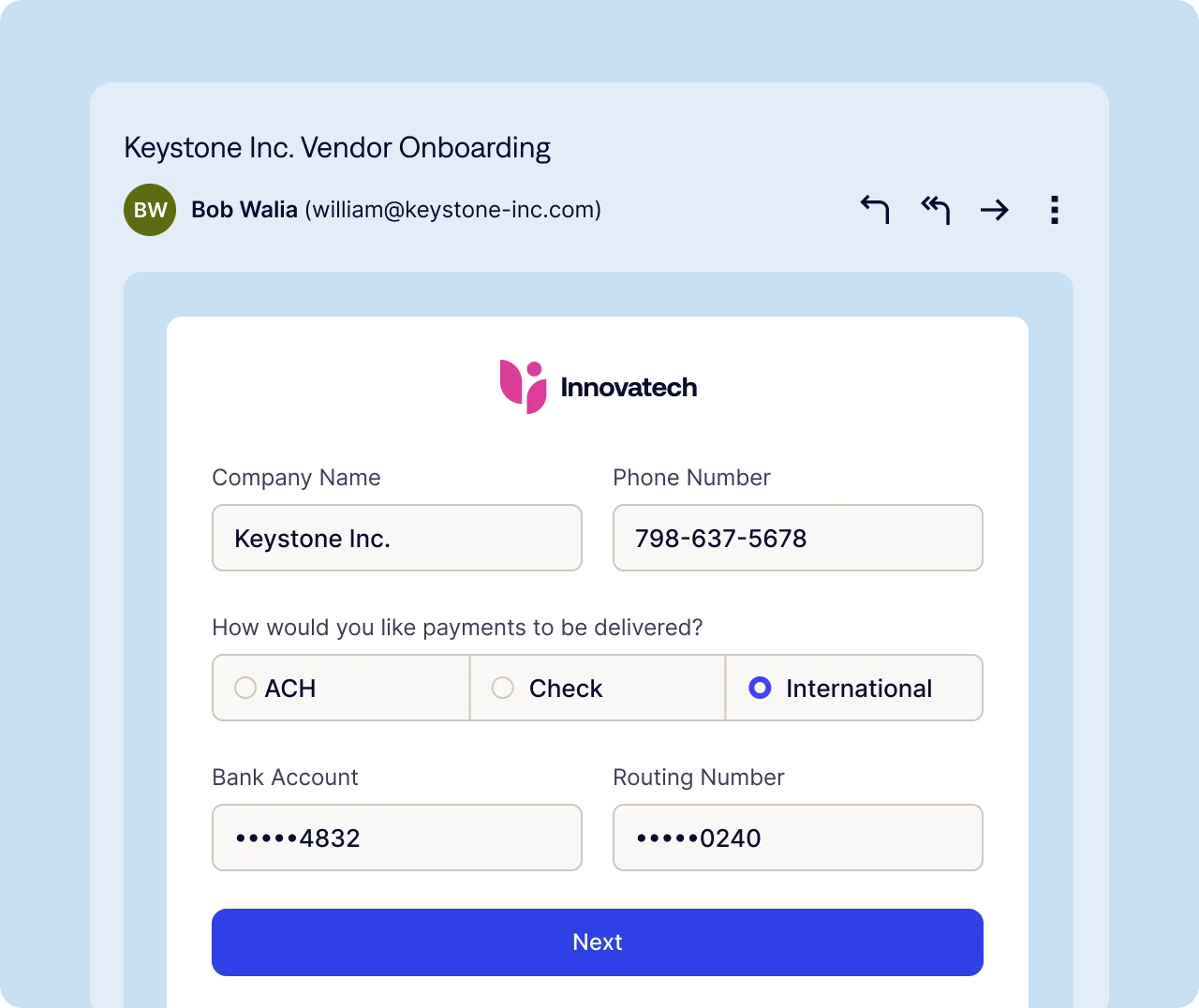

Vendors directly enter their banking details through secure forms. Charted immediately captures and encrypts all sensitive payment data within our SOC2-compliant platform, ensuring bank-level security while maintaining appropriate user access controls. This approach delivers a seamless user experience with enterprise-grade security.

Yes, we maintain full compliance with international payment regulations, AML, and KYC requirements across all supported countries. Domestic payments follow standard US banking regulations. All payment types maintain consistent compliance standards within the unified platform, ensuring no regulatory gaps between systems.