Payment Automation for NetSuite

Complete Payment Automation that never leaves NetSuite

End the security risks and inefficiencies of juggling multiple payment systems. Process all your vendor payments—ACH, checks, and international transfers—with automation that handles approvals and fraud prevention, all within a single unified workflow in NetSuite.

Why Charted?

Why finance teams choose Charted Payment Automation

Charted Payment Automation features

Transform your payment workflow with Payment Automation for NetSuite

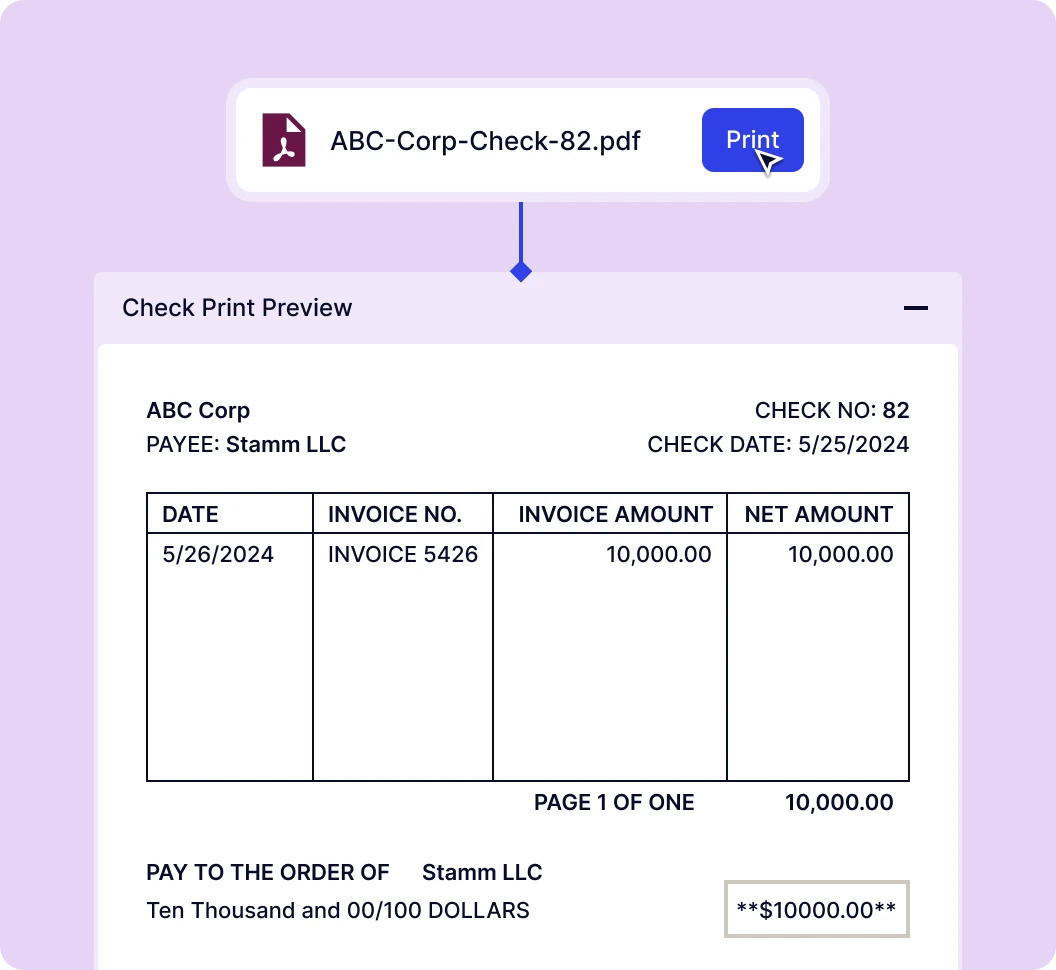

ACH Payments

ACH payments without file transfers

Process electronic payments using your existing bank accounts, eliminate vulnerable NACHA file handling, and track payment status in real-time—all within NetSuite.

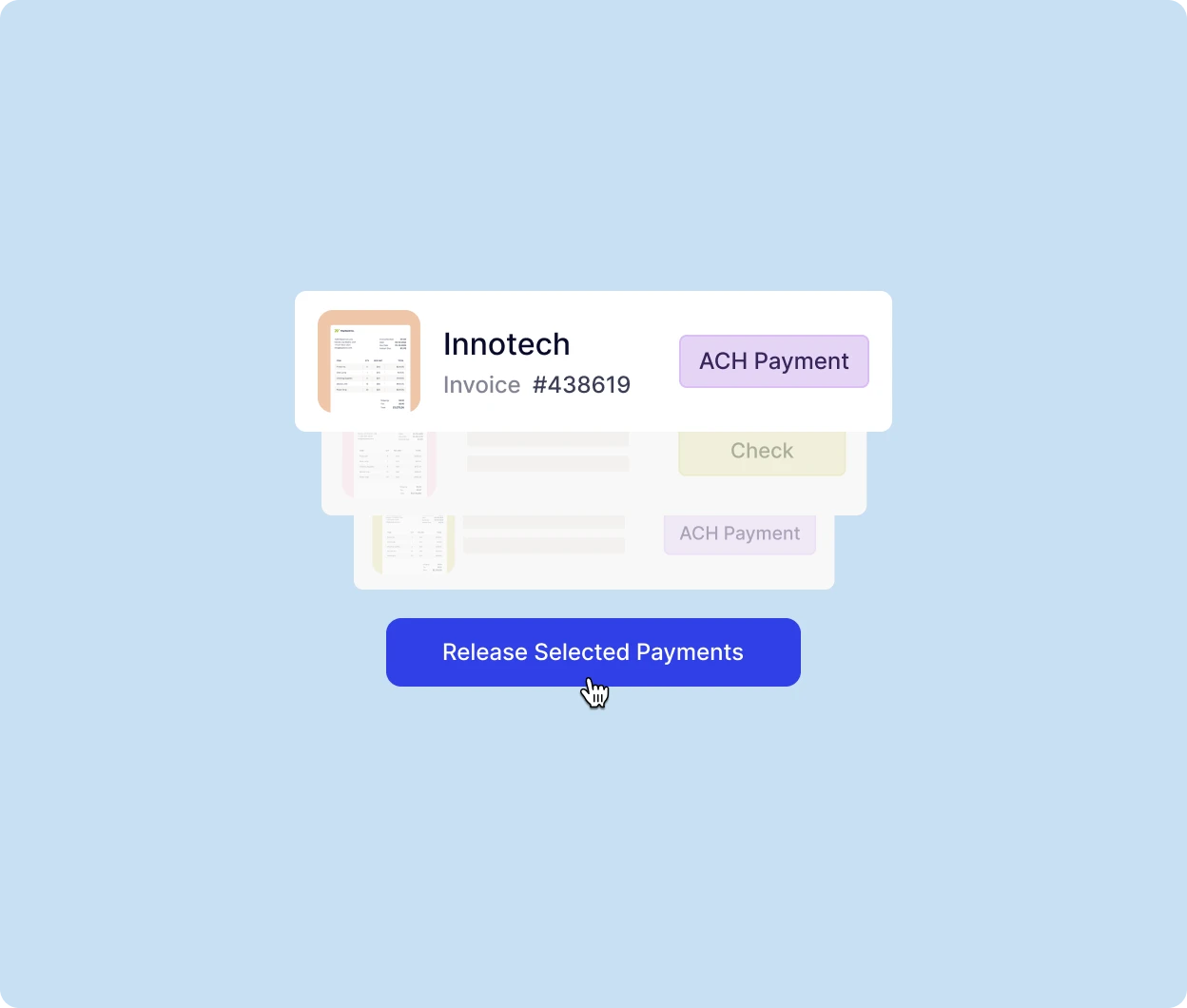

Check Printing

Flexible check payment options

Choose between on-premise printing with digital signatures or outsourced processing—saving 70%+ versus manual processing while maintaining complete control.

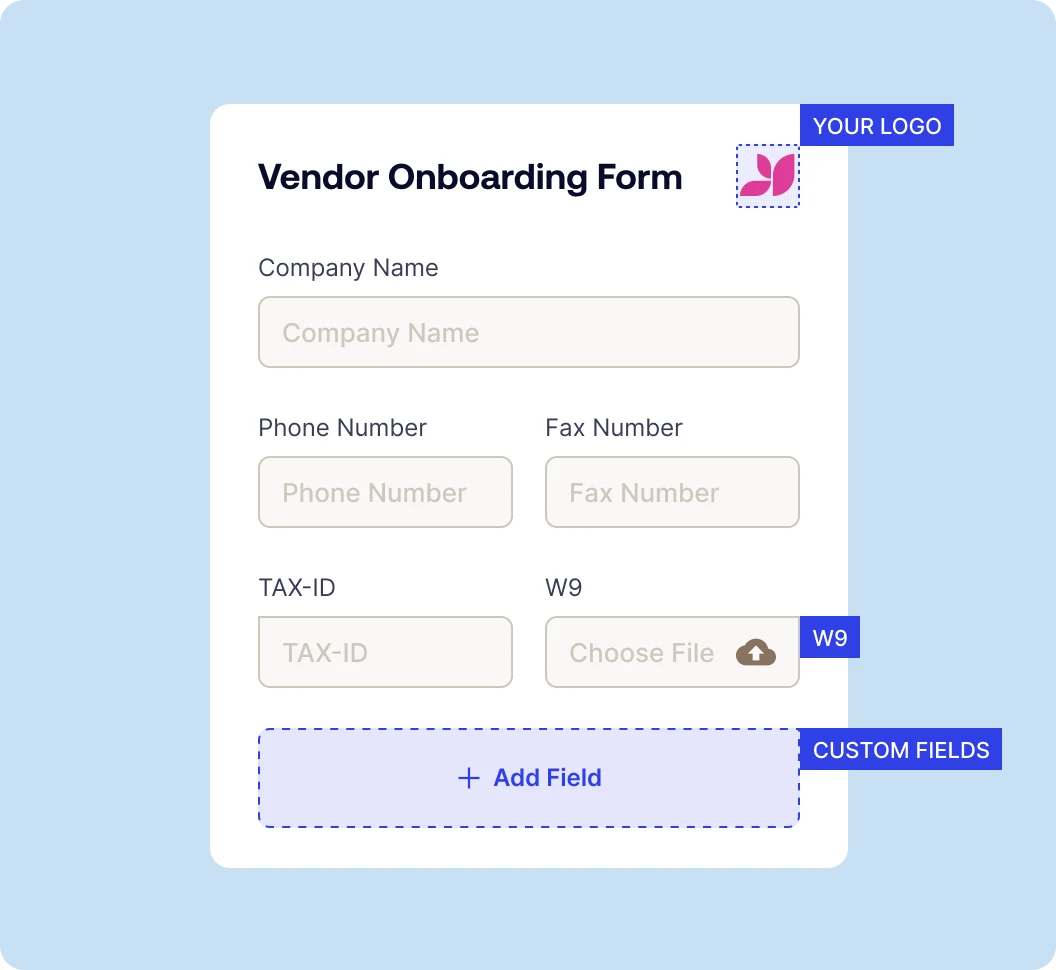

Vendor Onboarding

Fraud-proof vendor setup

Collect banking details through secure vendor onboarding forms, automatically update vendor records, and eliminate fraud risks from manual data collection.

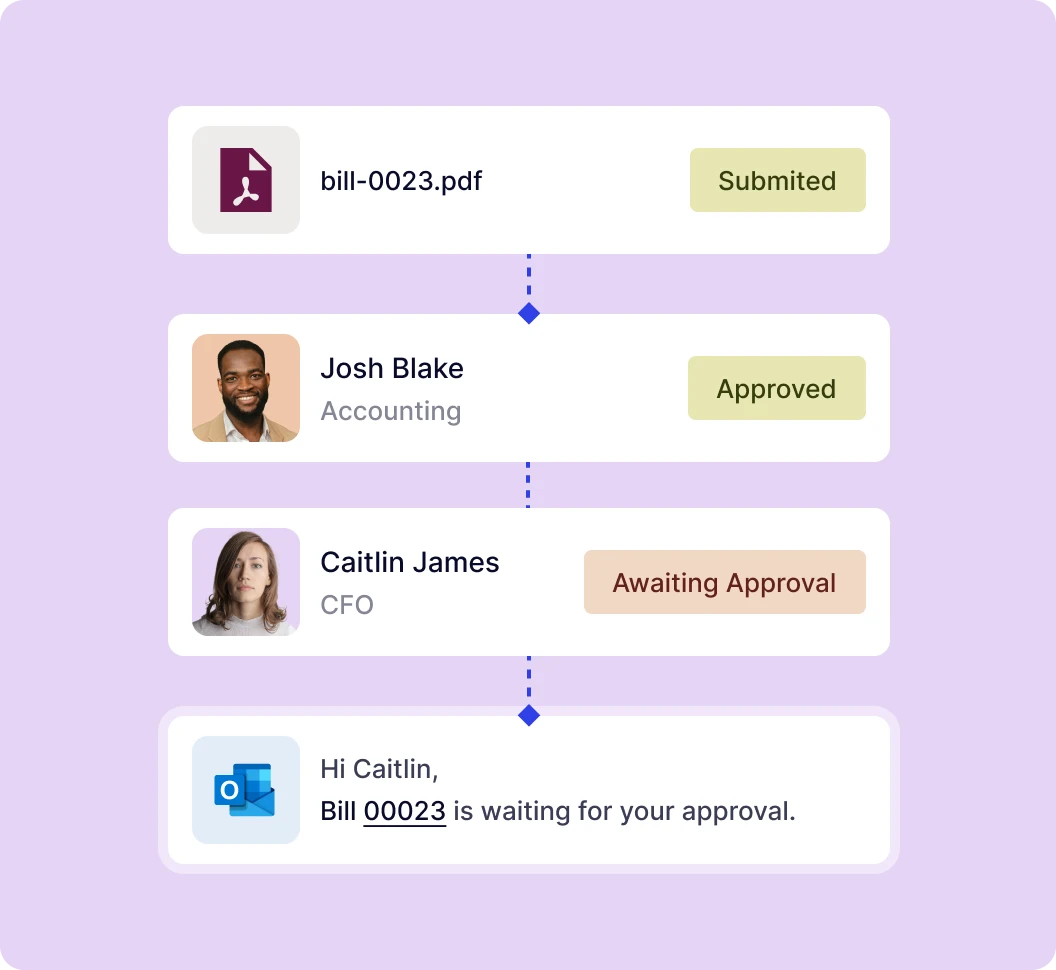

Approvals

Intelligent approval automation

Route payments to any stakeholder with configurable approval rules, enable approvals directly from email without NetSuite licenses, and maintain complete audit trails automatically.

International Payments

Global payment processing

Pay international vendors through IACH (International ACH) or SWIFT wire transfers. Competitive FX rates and streamlined processing eliminate manual banking steps while supporting 160+ countries.

Customer success story

Payment Automation for NetSuite

Frequently asked questions

Charted Payment Automation is built as native SuiteApp that that embeds directly within your existing NetSuite environment. No external systems, middleware, or data syncing required—everything happens seamlessly within NetSuite’s interface.

We support ACH payments through any US bank, on-premise check printing with digital signatures, outsourced check processing, and international payments via IACH and wire transfers to 150+ countries—all from one unified platform.

You have full control over payment timing through our “Ready for Release” queue. Payments created in NetSuite flow into this queue where you can review, organize, and release them in batches based on when you want them processed. This gives you complete control over cash flow timing while maintaining strong internal controls.

Configure approval workflows based on amount thresholds, departments, or other criteria specific to your organization. Approvers receive secure email notifications and can approve payments directly from their inbox without requiring NetSuite licenses, while maintaining complete audit trails.

Yes, our system includes built-in duplicate payment detection, two-factor authentication for vendor onboarding, and secure vendor bank detail collection. Our system also eliminates manual NACHA file transfers that can be vulnerable to tampering.

Absolutely. Our solution supports unlimited subsidiaries and multiple bank accounts, allowing you to process batch payments across your entire organization while maintaining proper entity-level controls and approval workflows.