NetSuite Procure-to-Pay

Streamline your end-to-end P2P process

Deliver real business impact with P2P and AP automation in NetSuite. At Charted, we combine deep expertise in NetSuite configuration with proven process optimization strategies to streamline the entire P2P process. With a flexible, agile approach, and track record of zero failed projects, we’re trusted by companies across industries to transform your operations and turn ERP goals into reality.

Trusted by leading organizations:

Charted implementation success

A proven track record

Zero

failed implementations, ever

1,200+

services projects

98%

customer retention rate, built on strong relationships and support

How we help

NetSuite Procure-to-Pay that meets your business needs

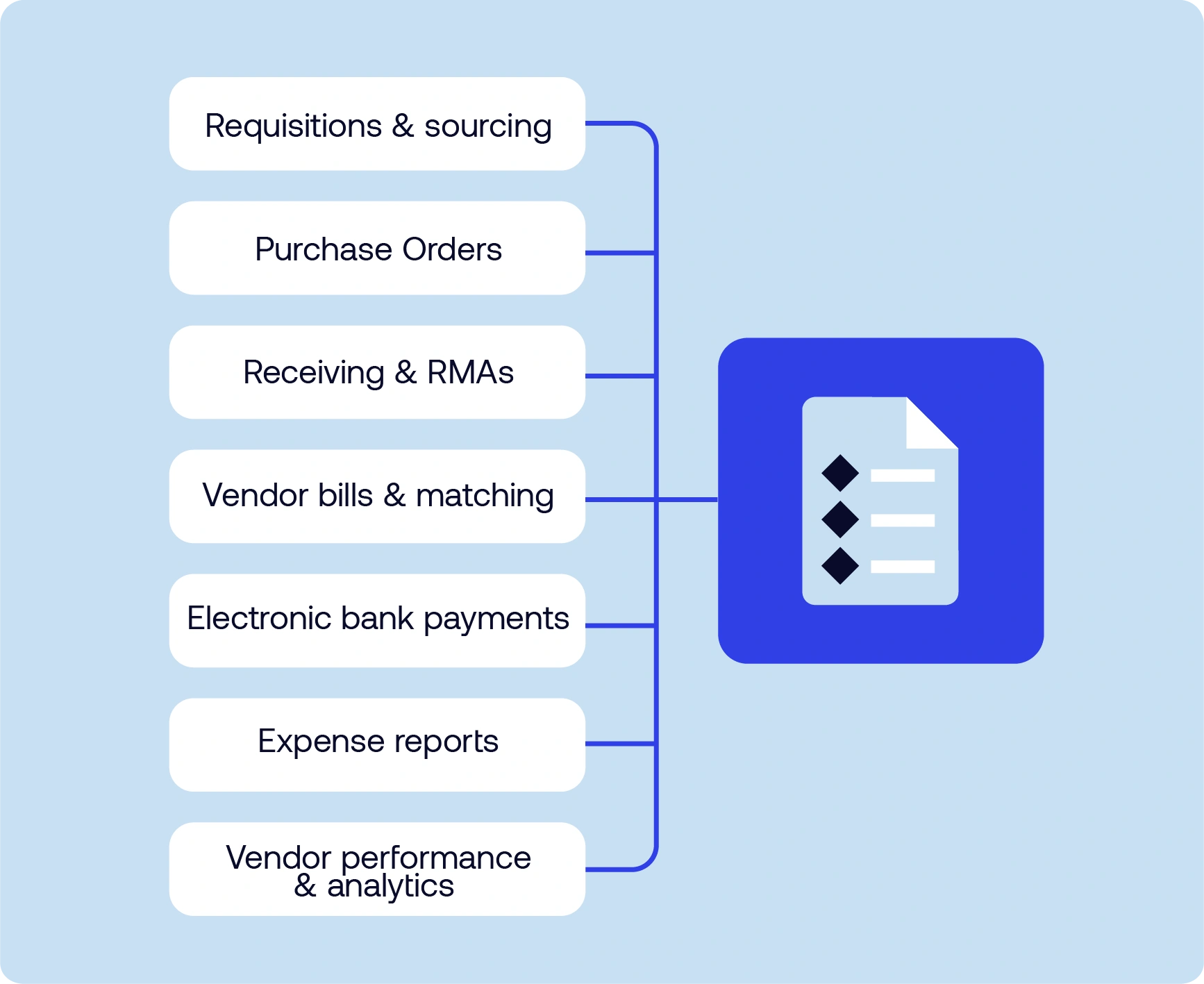

NetSuite streamlines purchase order creation, minimizing errors and shortening procurement cycles. Charted expert consulting ensures approval hierarchies and system integrations align with corporate policies for maximum efficiency.

NetSuite enhances receiving processes with real-time inventory updates and barcode scanning, improving accuracy and reducing delays. Charted consulting services optimize RMA workflows to accelerate returns and strengthen customer satisfaction.

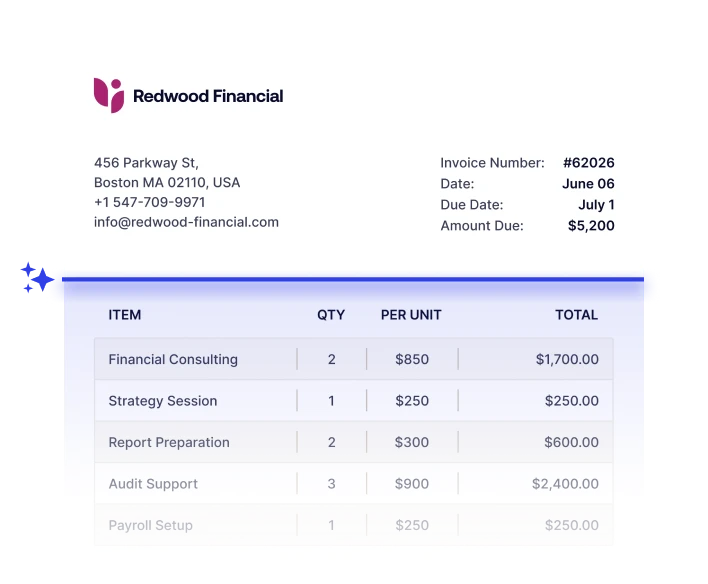

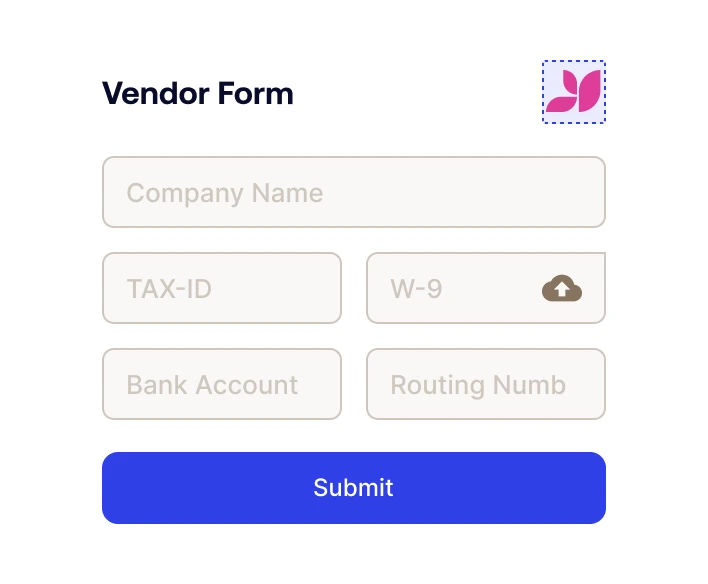

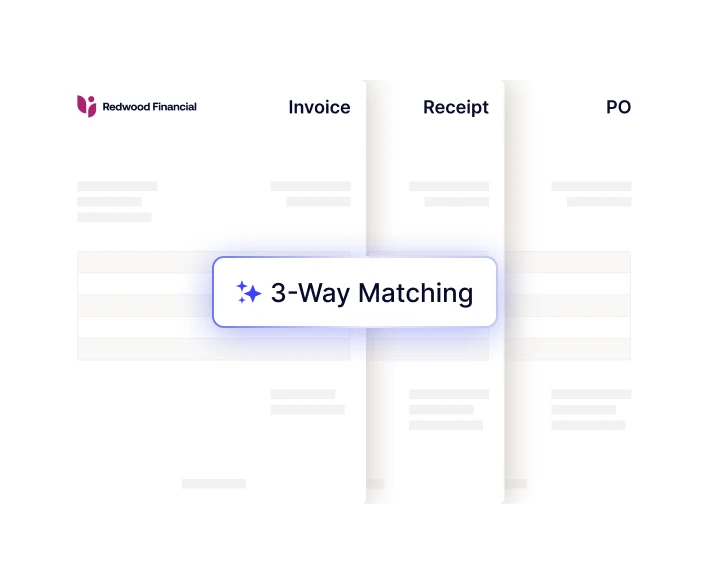

Automated two-way and three-way matching in NetSuite eliminates manual reconciliation, reducing discrepancies and fraud risk. Our Charted consultants design invoice approval workflows that improve accounts payable efficiency and cash flow visibility.

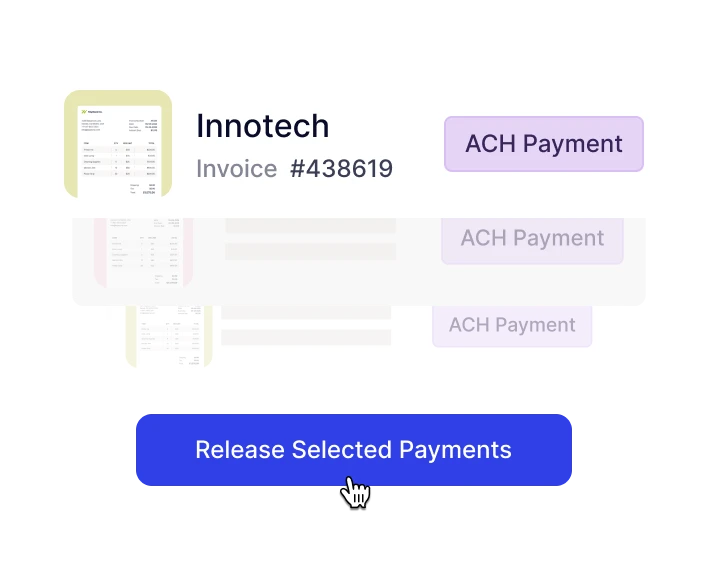

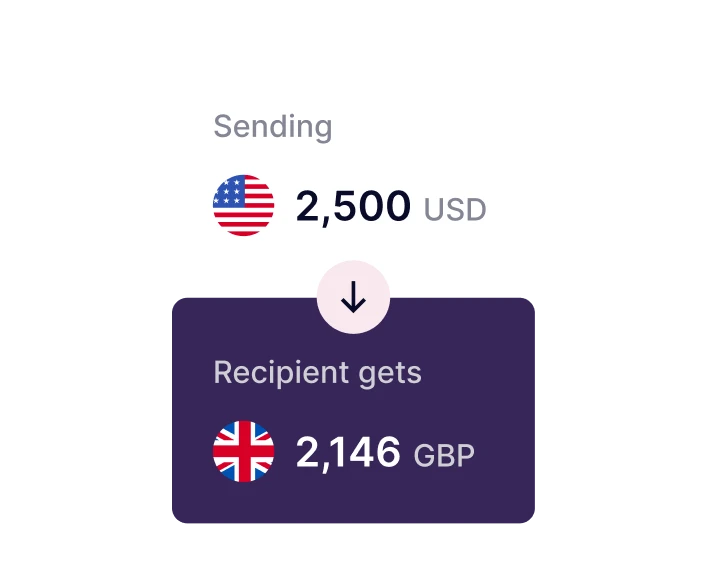

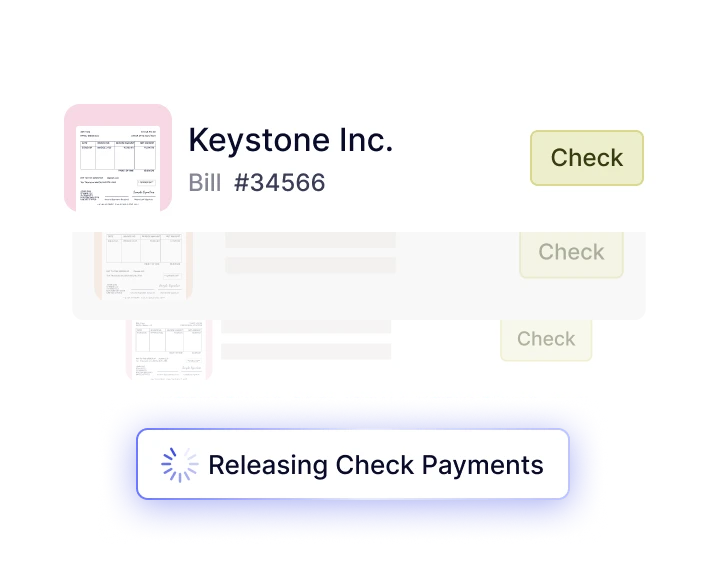

NetSuite simplifies electronic bank payments through automated scheduling and secure fund transfers, ensuring compliance with global standards. Charted Services configure payment processes to reduce banking fees and enhance financial control.

Enable mobile expense capture and automated approvals, reducing administrative overhead and enforcing policy compliance. Configure expense categories and reporting structures to align with organizational goals.

Deliver advanced dashboards and KPIs for vendor performance, enabling data-driven sourcing decisions and cost optimization. Charted consultants create tailored analytics and scorecards to strengthen supplier relationships and improve procurement strategies.

Customer success story

Features

Everything you need for AP, built into NetSuite

Frequently asked questions

NetSuite AP automation streamlines invoice processing, approvals, and payments by eliminating manual tasks and reducing errors. The Charted consulting team specializes in end-to-end NetSuite AP implementation, including workflow configuration, system integration, and best-practice setup to ensure faster processing and improved compliance.

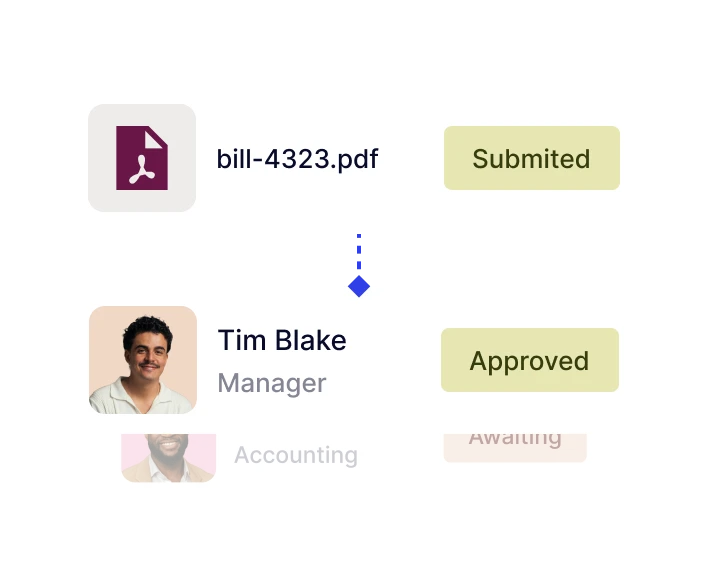

Charted leverages NetSuite’s automation tools alongside our AP Automation solutions to configure invoice capture, three-way matching, approval hierarchies, and vendor bill workflows to eliminate bottlenecks. Our consultants bring years of experience optimizing AP processes, ensuring accurate data capture and reducing cycle times by up to 50%.

Yes, the Charted team can design and implement automated three-way matching between purchase orders, receipts, and vendor bills to prevent discrepancies and fraud. Charted consulting services include customizing approval workflows and compliance rules to fit your organization’s unique requirements.

The Charted consulting team can configure NetSuite’s electronic payment capabilities to ensure automated vendor payments are completely secure and maintain global compliance standards. Our expertise ensures seamless integration with banking systems, reducing payment errors, improving cash flow visibility, and lowering transaction costs.

Our consultants implement dashboards, KPIs, and audit-ready workflows that provide real-time insights into AP performance and vendor obligations. We also configure compliance controls and approval processes to meet regulatory standards and internal governance requirements.

Accounts Payable (AP) refers specifically to the process of managing and paying vendor invoices. AP focuses on tasks like invoice receipt, approval, matching purchase orders to invoices and bills, and making payments. Procure-to-Pay (P2P) is a larger, end-to-end process that starts with requisitioning goods or services and ends with payment to the supplier. It includes sourcing, purchase orders, receiving goods, invoice processing, and payment.